Personal Insurance

What is causing the home insurance rate increase?

The home insurance rate increase is stemming from the perfect storm of market trends that have driven up the cost of building homes — and with it the cost of insuring them for repair and replacement.

More severe weather

There have been 18 weather/climate disaster events in the U.S. in 2021 with losses exceeding $1 billion

in damage. The increase in severe weather caused 39% of all U.S. home insurance claims.

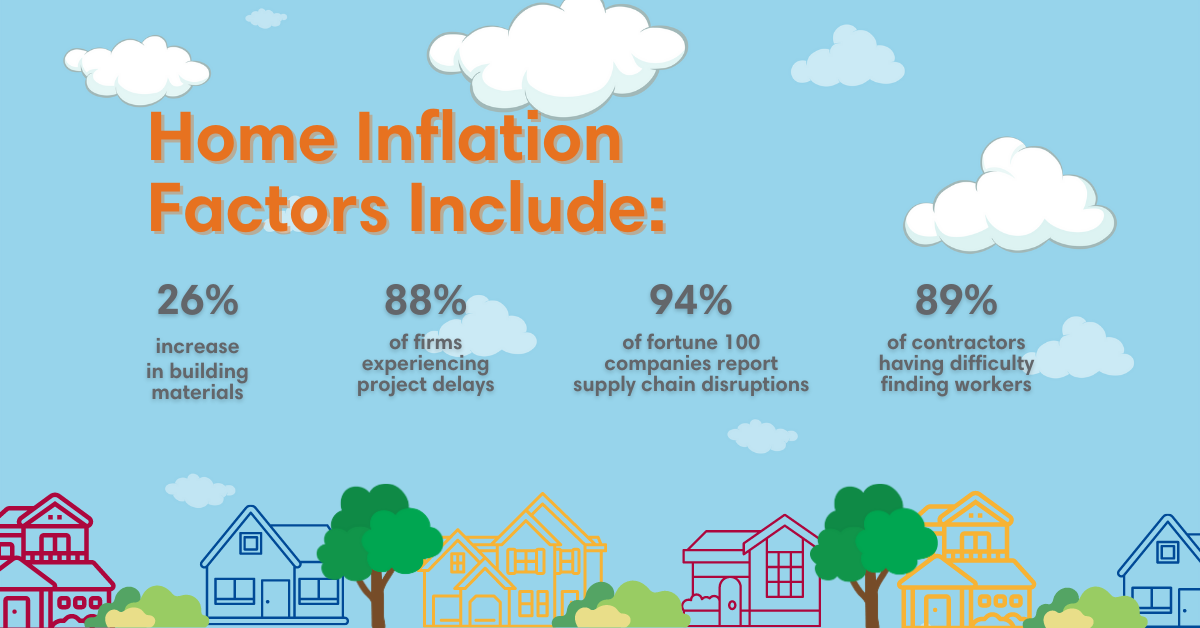

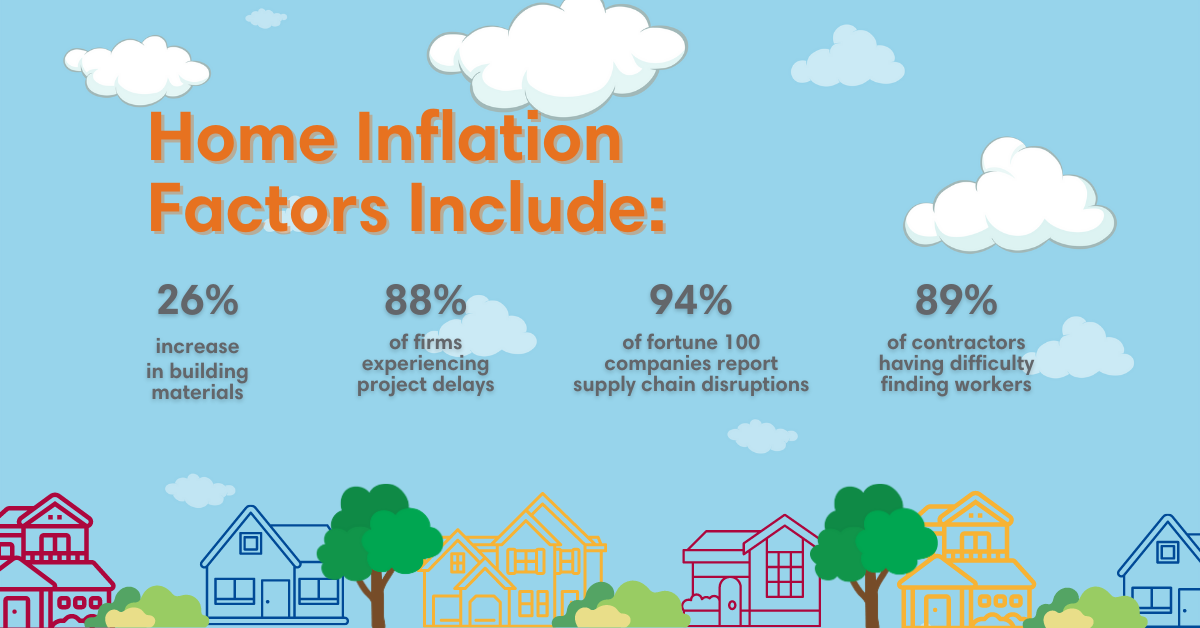

Higher material costs

With the cost of building materials up an average of 26%, homes have become more expensive to fix

and replace. Last year alone, the cost of building materials rose 14.1%. Lumber has played an outsized role in that inflationary trend, more than tripling in price since March 2020.

Increased shipping costs and delays

The pandemic has impacted almost every part of the global supply chain causing shipping delays and higher prices. 95% of Fortune 1000 companies have reported supply chain disruptions from COVID-19.

More fire damage

Newer homes burn more nearly 6x faster than older ones due to the use of synthetic materials and open-floor plans, resulting in more total losses from fire and higher rebuild costs.

Higher labor costs

The home-building industry is currently facing a shortfall of at least 200,000 skilled trade workers. About 60% of surveyed builders report a skilled labor shortage. Nearly 90% of contractors are having a hard time finding craft workers and 88% of firms are experiencing project delays. Higher labor costs drive up the price of materials leading to a rise in home insurance.

Bigger, upscale homes

Home interiors have become more upscale with custom cabinetry, hardwood floors, finished basements and more, leading to higher replacement costs when damages arise

Low housing inventory and historic demand

In March 2022, there were only 870,000 unsold homes on the market, down 60% over the past two years. As a result, the median price of homes sold in the U.S. has surged 23% since 2019.

Increase in water damage

Water damage and freezing losses have increased by more than 10% from 2017 to 2019.

We can help you avoid your home being underinsured. Contact a Relation Home Insurance expert today to make sure you have the right coverage… and enough of it.

Sources: NAHB, AGC, Accenture, U.S. Bureau of Labor Statistics, AutoRentalNews, CCC Intelligent Solutions, CNBC