Nonprofits are built on a mission to serve, uplift, and drive meaningful change. While their focus is on improving lives and communities, navigating the complexities of risk and insurance can often feel overwhelming. That’s where trusted partners like Relation Insurance’s Lauren Erickson come in—bringing expertise, responsiveness, and a relationship-first approach to ensure nonprofits have the coverage they need to thrive.

Going Beyond the Policy: Lauren Erickson’s Commitment to Nonprofits

The unique risks that nonprofits face require more than a one-size-fits-all solution. Lauren Erickson has built her career on understanding the distinct needs of nonprofit organizations and crafting bespoke insurance solutions that align with their mission and operations. Her dedication and expertise have earned her the prestigious title of 2025 Nonprofit Power Broker—an honor that reflects her commitment to outstanding client service, problem-solving, and industry knowledge.

But don’t just take our word for it—Lauren’s clients say it best.

“We were just starting out as a new nonprofit with a unique risk profile. We run a restoration crew with forestry work, chainsaw work, prescribed fire—which gives us a higher risk, because you usually see prescribed burns with firefighting companies or timber operations, but we are neither of those things,” shared Lindsay Dailey, Executive Director of the Tribal EcoRestoration Alliance.

The nonprofit’s previous broker didn’t take the time to fully understand their work. When their renewal deadline loomed and frustration mounted, Lauren stepped in.

“She was responsive. It was night and day starting to work with Lauren and her team, and they took the time to learn our operations, who we serve, our program,” Dailey said.

This “night and day” difference is a common theme in the experiences of Lauren’s clients. Sam Chery, Assistant General Counsel at TSNE, echoed a similar sentiment.

“Lauren is a business partner to us,” Chery shared. “In the last two years, I’ve learned so much about how insurance works and works for us thanks to Lauren. Her philosophy is to be a partner first.”

The Power of Partnership in Insurance

At Relation Insurance, we believe in a teammate approach to insurance. Our goal isn’t just to provide policies—it’s to understand your business, your customers and your unique needs.Our mission is to build lasting relationships that help us serve solutions that empower our clients to focus on their mission with confidence. Lauren’s recognition as a 2025 Nonprofit Power Broker is a testament to this philosophy in action.

What Is a Power Broker?

The Risk & Insurance Power Broker® designation is awarded to individuals who stand out among their peers for exceptional client service, problem-solving abilities, and industry knowledge. Winners are selected based on client testimonials, highlighting the direct impact they have had on organizations. Lauren’s recognition reflects her deep commitment to serving the nonprofit sector with expertise and care.

Ready to Partner with a Team Who Puts You First?

Insurance should never be a roadblock to achieving your mission. At Relation Insurance, we specialize in crafting tailored solutions for many industries, including nonprofits. If you’re looking for a trusted partner who will take the time to understand your unique risks and advocate for your needs, let’s talk.

Read the original article on Risk & Insurance here

Find a Location and Contact us today to see how Relation Insurance can help protect your mission.

The insurance industry is undergoing a significant transformation as it adapts to emerging trends driven by climate change and technological innovation. Two key developments are reshaping the landscape: the rising impact of climate-related risks on insurance costs and the shift toward proactive risk management.

Climate Impact on Your Insurance Costs

Climate change is no longer a distant concern but a present reality with far-reaching implications. Homeowners in disaster-prone areas feel financial strain as insurance premiums soar due to heightened climate risks. This trend is particularly pronounced in Western and Eastern states, where wildfires, hurricanes, and flooding are becoming more frequent and severe.

Insurance carriers are reevaluating their pricing models to account for these risks. For instance:

- Increased Premiums: Homes in high-risk areas are experiencing steep rate hikes, with some homeowners facing double or even triple their previous premiums.

- Coverage Limitations: Insurers impose stricter policy terms, reducing coverage for specific climate-related damages.

- Market Withdrawals: In extreme cases, some insurers are withdrawing from high-risk markets altogether, leaving homeowners with limited coverage options.

These changes underscore the importance for consumers understanding their risk profile and exploring preventative strategies, such as retrofitting homes to withstand disasters or investing in renewable energy solutions that may qualify for premium discounts.

Proactive Risk Management: Your Partner In Insurance

Another transformative trend that Relation Insurance is embracing, is the pivot towards proactive risk management. Instead of merely reacting to claims, we are working with carriers who are leveraging advanced technologies to predict and prevent risks. This proactive approach not only reduces losses but also helps our team fosters stronger customer service for our clients.

Here’s how proactive risk management is taking shape:

- Predictive Analytics: Carriers use data analytics and artificial intelligence to identify patterns and predict potential risks. For example, AI-powered models can forecast weather-related events, allowing our team of experts to advise policyholders on precautionary measures.

- IoT Integration: The Internet of Things (IoT) plays a crucial role. Smart home devices, such as water leak detectors and fire alarms, enable real-time monitoring and alerts, helping policyholders prevent damages before they occur.

- Customized Solutions: Proactive engagement allows our team of experts to offer tailored solutions. For instance, a customer living in a flood-prone area might receive specific guidance on how to minimize risk.

For policyholders, this shift means more than just financial protection. It’s about peace of mind and the assurance that we are a partner in safeguarding their assets and well-being.

Navigating These Trends as a Policyholder

As these trends evolve, clients should stay informed and take a proactive approach to their insurance needs. Here are some actionable tips:

- Assess Your Coverage: Regularly review your policy to ensure it reflects current risks and offers adequate protection.

- Invest in Risk Mitigation: Explore ways to reduce your risk profile, such as upgrading your home’s resilience to natural disasters.

- Leverage Technology: Consider installing IoT devices that provide early warnings and reduce the likelihood of damage.

- Engage with Your Insurer: Open communication with your insurance provider can help you understand available resources and proactive measures.

The Road Ahead

The insurance industry’s response to climate change and technological advancements signals a new era of innovation and customer-centricity. At Relation, we are excited to provide opportunities to collaborate with our clients to build a more resilient future. By staying informed and embracing these trends, our clients can better navigate the evolving landscape and secure the protection they need in an uncertain world.

Partner with Relation Insurance

Interested in working with team of insurance experts who specialize in Proactive Risk Management? With Relation Insurance —you’ve got a local partner right around the corner with buying power all over the country. That’s because we’re backed by a national network with deep, specialized expertise and long-standing relationships with a vast network of carriers. It means you get more choices, and more ways to find the perfect fit for the protection you need. Whether for personal or business, let us change the way you think about insurance.

As a vineyard owner, safeguarding your crops against unforeseen events is crucial. The Federal Crop Insurance deadline is fast approaching on January 31, with coverage commencing on February 1. This insurance is essential for protecting your vineyard from potential losses due to natural disasters, pests, or diseases.

What’s new in Crop Insurance for 2025:

- Enhanced Coverage Option (ECO): County-based coverage option allowing you to insure up to 95% of your crop value using county-based losses.

- Fire Insurance Protection – Smoke Index (FIP-SI) – County-based smoke exposure coverage option allowing you to add additional smoke coverage to your underlying policy using county-based NOAA air quality data to determine a loss.

Want to learn more about the Federal Crop Insurance Program? Check out the recorded webinar hosted Agribusiness Risk Expert, Kristine Fox in partnership with CAWG, that covers the ins and outs of crop insurance, featured on Wine Business.

Comprehensive Agribusiness Insurance Solutions

Relation Insurance Services has been a trusted partner in the agribusiness sector for over 75 years, offering tailored insurance solutions to meet the unique needs of agricultural businesses. Their expertise spans various areas, including:

- Crop Insurance: Protects your crops from losses due to natural disasters.

- Workers’ Compensation: Ensures your employees are covered in case of work-related injuries.

- General Liability Packages: Offers protection against potential legal claims.

- Life and Health Benefits: Provides comprehensive benefits for you and your employees.

- Loss Control Services: Helps in identifying and mitigating potential risks.

- Farm Labor Contractor (FLC) Licensing Assistance: Assists in navigating the complexities of FLC licensing.

- Claims Management Assistance: Supports you through the claims process to ensure timely resolutions.

- Compliance Training: Keeps your business up-to-date with the latest regulatory requirements.

By partnering with Relation Insurance Services, you can ensure your vineyard is well-protected, allowing you to focus on producing quality wine.

Success Stories in Agribusiness Insurance

Relation has a proven track record of assisting Agribusiness clients in managing risks effectively. For instance, our team a helped a California-based grower-shipper launch a new company by designing a health insurance program that closely mirrored his existing coverage. We also facilitated a client’s entry into a group captive insurance company for workers’ compensation, resulting in significant cost savings.

Act Now to Secure Your Vineyard’s Future

With the January 31 deadline looming, it’s imperative to review your crop insurance options promptly. Partnering with experienced providers like Relation Insurance Services can offer you peace of mind, knowing that your vineyard is protected against potential risks. Don’t miss this opportunity to safeguard your investment and ensure the longevity of your vineyard.

For more information on Agribusiness Insurance Solutions, connect with one of our US Locations today.

Winter storms and cold snaps bring a unique set of challenges for homeowners and business owners alike. By preparing ahead of time, you can safeguard your property, loved ones, and customers from the harsh realities of severe weather. Below we walk through some essential steps to help you stay protected when the temperatures plummet.

Prevent Freezing Pipes and Water Damage

Frozen pipes can lead to costly damage, but a little preparation goes a long way:

- Insulate pipes: Pay special attention to pipes in attics, basements, and along exterior walls. Seal cracks and gaps with insulation or caulking.

- Monitor heating fuel levels: Before the cold sets in, check your fuel levels and schedule a refill if necessary.

- Locate your water shut-off: In the event of a burst pipe, shutting off the water promptly can prevent extensive damage. Know where your shut-off valve is located.

- Service sprinkler systems: Ensure your sprinkler system is serviced and consult with a professional about freeze prevention.

- Encourage warm airflow: Open indoor cabinets to allow warm air to circulate around pipes.

- Allow faucets to drip: Running water is less likely to freeze, so let faucets trickle during extreme cold.

- Set your thermostat: Maintain a minimum indoor temperature of 60 degrees Fahrenheit.

- Thaw pipes safely: If pipes freeze, use a hair dryer, space heater, or another safe method—never an open flame—to thaw them.

- Business precautions: Regularly monitor your building’s heating systems to catch problems early.

Manage Snow Loads and Ice Dams

Heavy snow and ice can damage roofs and lead to water backups. Take these steps to minimize risk:

- Clear snow responsibly: Use a roof rake to remove snow from the bottom four feet of your roof and around chimneys and valleys.

- Identify hazards: Before removing snow, locate skylights, vents, and other obstacles to avoid accidents.

- Practice ladder safety: Position your ladder on stable, ice-free ground and ensure it’s securely set.

- Use a safety harness: For steep roofs, consider hiring a professional. If you’re tackling the task yourself, wear a safety harness to reduce fall risks.

General Severe Cold Weather Preparation

Being ready for extreme weather ensures the safety of your household or business. Here’s how:

- Stock emergency essentials: Keep blankets, batteries, portable phone chargers, flashlights, drinking water, and non-perishable food on hand.

- Check detectors: Test smoke and carbon monoxide detectors to confirm they’re functioning properly.

- Plan for power outages: Seal drafts and keep exterior doors and windows closed to retain heat.

- Limit travel: If travel is unavoidable, carry a winter emergency kit with warm clothing and supplies.

- Protect children and pets: Keep everyone inside as much as possible. Pets should only go out briefly.

- Avoid unsafe heating methods: Never use gas ovens, grills, or other open-flame appliances indoors for heat, as they produce toxic fumes.

Why Preparation Matters

Taking proactive steps before winter’s worst hits isn’t just about avoiding inconvenience; it’s about protecting your home, your business, and the people who rely on you. Whether it’s insulating pipes, clearing snow, or stocking emergency supplies, every action adds a layer of security.

At Relation Insurance, we understand that life doesn’t pause for a snowstorm. That’s why we’re here to help you plan ahead, so you can focus on what matters most—your family, your business, and your peace of mind.

Find an Insurance location near you and talk to one of our experts. Your partner in protection. For Life’s Unpredictable moments.

Your Home Office: A Space Worth Protecting

These days, your home office isn’t just where you work—it’s where creativity happens, goals are crushed, and dreams come to life. That’s why taking care of it matters! As we mark Home Office Safety and Security Week, let’s chat about simple but important ways to keep your workspace safe from fire, theft, and cybersecurity risks while also making sure your valuable equipment is properly covered.

Why Your Home Office Deserves Extra TLC

Working from home has its perks—hello, comfy socks and coffee refills—but it also means your home office faces unique risks. Think about it: your space likely holds pricey tech, sensitive info, and important papers. A little planning now can help protect all that from unexpected mishaps like fires or online threats.

Easy Ways to Keep Your Home Office Safe

🛡️ Prevent Fire Hazards

- Check Your Cords: Make sure wires and equipment aren’t frayed or overloaded.

- Use Surge Protectors: These little lifesavers shield your gadgets from power spikes.

- Keep a Fire Extinguisher Nearby: Know where it is and how to use it (just in case).

- Don’t Overheat Devices: Avoid leaving laptops or chargers running unattended for too long.

🔒 Guard Against Theft

- Secure the Space: Add locks to nearby windows and doors for extra peace of mind.

- Use a Safe for Valuables: Perfect for stashing important docs or gadgets when you’re away.

- Consider a Security System: Cameras or alarms can help protect your space.

💻 Step Up Your Cybersecurity Game

- Create Strong Passwords: Think unique and complex for all your devices and accounts.

- Enable Two-Factor Authentication: It’s an extra layer of defense for sensitive info.

- Keep Software Updated: Regular updates for systems and antivirus programs go a long way.

- Secure Your Wi-Fi: Use a strong password or even a VPN for added safety.

Protect What You’ve Built

No matter how prepared we are, surprises happen. That’s why it’s a smart move to make sure your home insurance covers your office equipment. Policies can help safeguard:

- Computers, printers, and electronics

- Furniture and office supplies

- Data recovery services if you ever face a breach

Let’s Make Your Space Safer This Week

Home Office Safety and Security Week is the perfect time to give your workspace a little extra love. With these tips and the right protection in place, you can stay focused on what matters most—doing amazing work in a space that feels safe, secure, and totally you.

Visit our Relation Locations page to find a local risk advisor to help you review your policy. Or Contact Us to have a risk advisor contact you to help identify any gaps in coverage. After all, a well-protected office isn’t just practical—it’s peace of mind. 💻✨

Since the pandemic, the shift toward digital operations in the business world has become a vital evolution. However, with the many benefits of a connected, online enterprise comes a slew of risks that traditional insurance packages, such as Business Owner’s Policy (BOP) Coverage Insurance, may not address. This gap has led to the increasing importance of Cyber Insurance for businesses, and it’s time you find an insurance broker who understands this is a crucial aspect of modern insurance coverage.

Why Is Cyber Insurance Important?

A 2022 Official Cybercrime Report by Cybersecurity Ventures predicted the global annual cost of cybercrime would reach $8 trillion in 2023—an amount greater than the annual GDP of every nation on Earth, barring China and the United States. And the cost of cybercrime isn’t expected to slow down, with damages projected to reach $10.5 trillion by 2025. Along with significant financial losses, businesses of all sizes may suffer reputational harm and lawsuits from affected customers.

How Misconceptions About BOPs Can Affect Insurance Brokers

Many businesses erroneously think that cyber threats are already covered under their BOP. But what does a Business Owner’s Policy cover? Typically, BOP Coverage Insurance addresses property damage, liability, and other conventional business risks. Cyber threats often fall outside this umbrella.

The Real Cost of a Cyberattack

The real cost of a cyberattack might surprise you. While CNBC reports the average cost of a cyberattack is $200,000, Business.com says the average cost of a data breach to a small business ranges from $120,000 to $1.24 million. Whatever the number, these can feel like abstract stats that don’t really apply to your business.

So, here are a few real claims examples we know of that might bring it closer to home:

- An online retailer went offline for six hours due to a cyberattack on the data center that hosted their site. The cost of recovering the website, lost revenue, and incident response expenses was $144,000.

- A public relations firm was hacked, and its system was infected with malware. IT forensics, legal, and notification costs were $50,000.

- A law firm had $118,830 fraudulently transferred overseas by cybercriminals posing as the firm’s bank.

- An employee in a manufacturing company clicked on a malicious link in an email, infecting the system with malware and encrypting all data. Incident response and recovery costs totaled $60,000.

Fortunately, all the above had cyber liability insurance so those costs and losses were covered. But without a policy, each company here would have been responsible for every dollar.

Is Your Company Covered For A Cyberattack?

Cybersecurity has now become a necessity for every business that uses technology. Could your company afford to pay the above costs or lose revenue due to downtime while you figure out how to respond to a cyberattack? With cyber liability insurance, you wouldn’t have to.

We can work with you to find what coverage best fits your needs. We’ll walk you through the process at every step to ensure your bottom line is protected and you have the resources to respond in case you are targeted.

Call one of Insurance experts today to make sure your business is protected from Cyber Threats.

April Is Distracted Driving Awareness Month. The National Safety Council recognizes April as Distracted Driving Awareness Month to help raise awareness about the dangers of distracted driving and encourage motorists like you to minimize potential distractions behind the wheel. Learn more on ways you can help prevent distracted driving.

Distracted Driving Overview

According to the Centers for Disease Control and Prevention, distracted driving refers to any activity that may divert a motorist’s attention from the road. There are three main types of distractions that can interfere with drivers’ attentiveness behind the wheel, including:

Visual distractions

These distractions involve motorists taking their eyes off the road. Some examples of visual distractions include reading emails or text messages, focusing on vehicle passengers, looking at maps or navigation systems, and observing nearby activities (e.g., accidents, traffic stops or roadside attractions) while driving.

Manual distractions

Such distractions entail motorists removing their hands from the steering wheel. Key examples of manual distractions include texting, adjusting the radio, programming navigation systems, eating, drinking or performing personal grooming tasks (e.g., applying makeup) while driving.

Cognitive distractions

These distractions stem from motorists taking their minds off driving. Primary examples of cognitive distractions include talking on the phone, conversing with vehicle passengers or daydreaming while driving.

Regardless of distraction type, distracted driving is a serious safety hazard that contributes to a significant number of accidents on the road. In fact, the National Highway Traffic Safety Administration reported that more than 2,800 people are killed and 400,000 are injured in crashes involving a distracted driver each year—equating to approximately eight deaths and 1,095 injuries per day. Considering these findings, it’s crucial to take steps to prevent distracted driving.

Distracted Driving Prevention Tips

Whenever you get behind the wheel, keep these distracted driving prevention measures in mind:

- Put away your phone. Silence your phone and store it in a location that is out of reach while driving to lower the temptation to check it.

- Plan your trip before you leave. Program your navigation system prior to hitting the road to get familiar with your journey and feel confident in your route.

- Don’t fumble with your playlist. Select a radio station or plug in a predetermined playlist before driving to limit the need for music adjustments.

- Secure passengers. Ensure kids are properly situated in car seats (if needed) with seat belts fastened. Keep pets stationary in the back seat.

- Avoid multitasking. Never complete additional tasks—such as eating or personal grooming—behind the wheel.

- Stay focused. Concentrate your mind on the road by keeping distracting conversations to a minimum and looking straight ahead.

This article is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional at Relation Insurance for appropriate advice.

©2023 Zywave,Inc. All rights reserved.

Recent market developments have demonstrated signs of an improving commercial insurance landscape. Yet, industry experts asserted that ongoing headwinds facing certain lines of coverage will continue to generate hardened conditions overall, therefore driving up premiums. As such, it’s essential for businesses to be aware of the following market trends and how they may impact coverage costs:

Labor shortages trends impacting commercial insurance costs

The last few years have seen widespread labor shortages, largely stemming from employees adjusting their job priorities in response to the COVID-19 pandemic. Such shortages have motivated some businesses to hire less experienced workers and place extra demands on existing employees to fill labor gaps; however, doing so can heighten liability exposures and increase the risk of workplace accidents, paving the way for rate jumps in several commercial insurance segments.

Supply chain disruptions trends impacting commercial insurance costs

Continued pandemic-related challenges, global transportation breakdowns and commercial driver shortages have slowed shipment and delivery times for many high-demand goods, creating supply chain issues for businesses across industry lines. These issues have led to considerable disruptions, prolonged recovery times, compounded claim expenses and elevated premiums in multiple commercial insurance segments.

Inflation issues trends impacting commercial insurance costs

In recent years, labor shortages and supply chain issues have fueled rising inflation concerns throughout the commercial insurance space, as evidenced by a surging consumer price index (CPI). Altogether, the elevated CPI has driven up claim costs, inflated total loss expenses and prompted rate hikes for various lines of coverage.

Recession risks trends impacting commercial insurance costs

Some economic experts have forecasted that the United States is headed toward a recession in the near future. During a recession, businesses usually experience decreased sales and profits, which may cause them to reduce their workforces and cut their spending to help maintain financial stability. Although having fewer employees could minimize occupational injuries and associated claims, limited funding for risk management and cybersecurity initiatives may create further liability exposures, making busi- nesses more vulnerable to increased losses and higher commercial insurance premiums.

Social inflation trends impacting commercial insurance costs

Social inflation refers to societal trends that push insurance costs above the overall inflation rate. Current drivers of social inflation include increased third-party litigation funding and the rise of anti-corporate culture. Amid these trends, businesses have been held more ac- countable for their wrongdoings, sometimes resulting in nuclear verdicts (jury awards exceeding $10 million). Social inflation has been a main factor in rising claim severity and rate jumps across many commercial insurance segments.

Extreme weather events impacting commercial insurance costs

Natural disasters (e.g., hurricanes, tornadoes, hailstorms and wildfires) continue to make headlines as they become increasingly devastating and costly. Making matters worse, these events aren’t limited to one geographic area; they impact establishments across the United States. Natural disasters have left businesses with significant repair and re- placement expenses, exacerbating losses and resulting in higher commercial insurance premiums.

During these challenging times, we are here to provide much-needed market expertise. Contact us today for additional risk management guidance and insurance solutions.

This article is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel or an insurance professional at Relation Insurance for appropriate advice.

©2023 Zywave,Inc. All rights reserved.

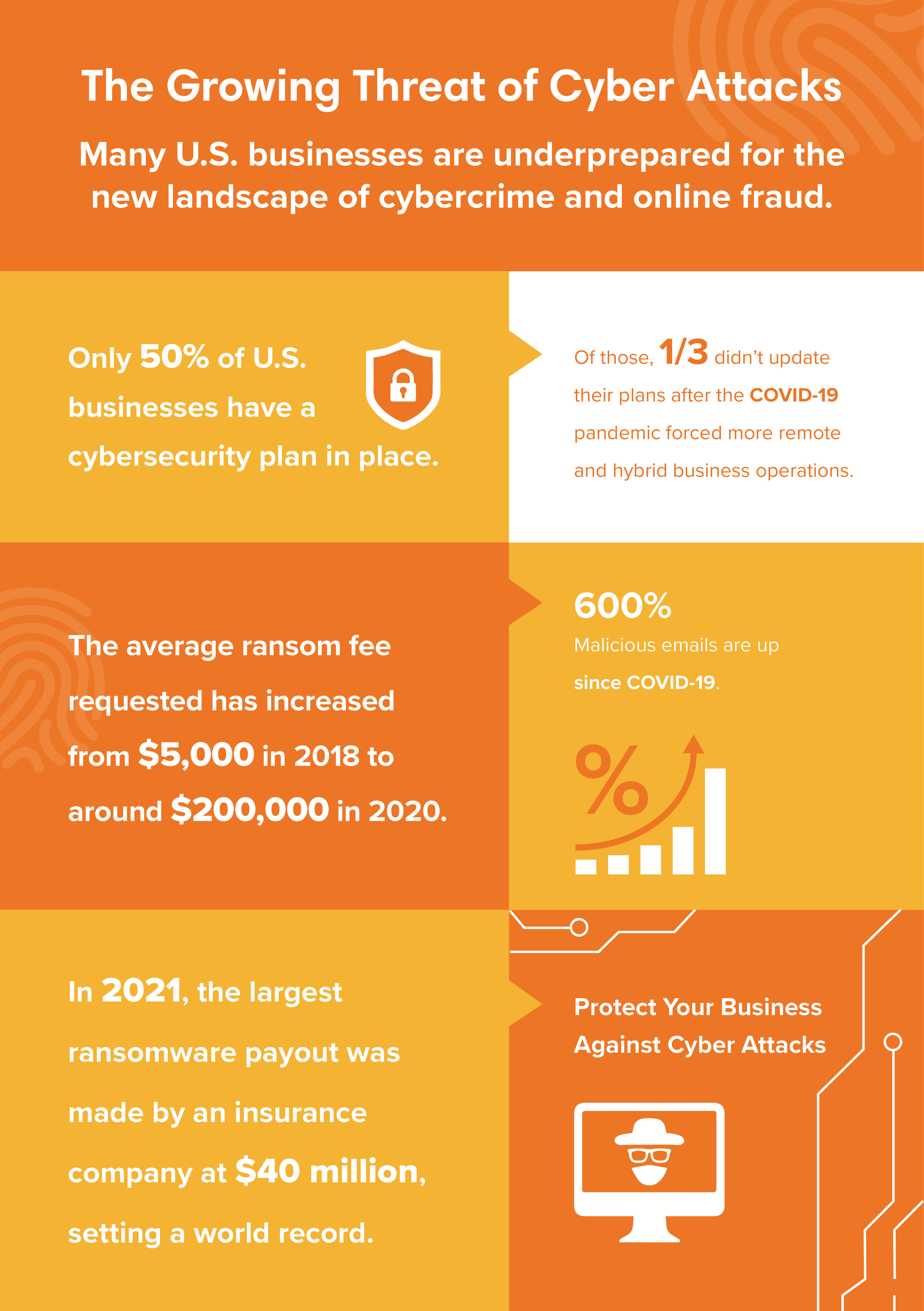

October is National Cybersecurity Awareness Month, and as the world grows digitally, cybercrime and online fraud are becoming more complex. Our experts have put together a helpful guide for you to assess your cyber risk and whether you may need to update your cybersecurity plan in order to protect your business against cyber attacks.

Do you have a cybersecurity plan in place?

Only half of all businesses in the United States have a cybersecurity plan in place – a shockingly low proportion, considering that cyber attacks do not discriminate. Every business, large and small, is a target. If you do not have a plan in place, now is the time to create one. (If you’re not sure where to start, you can reach out to a cybersecurity specialist for a free consultation!)

When was the last time you updated your cybersecurity plan?

Of the businesses that have a plan for cybersecurity, a third have never updated their plans after the increase in remote and hybrid work operations that came with COVID-19 in 2020. At a time when exposure and risk is rising exponentially, it’s imperative to revamp your cybersecurity plan. Experts recommend reviewing and adjusting your plan at least once per year to protect your business against the latest malware and cyber attack strategies.

How do you keep your team aware of online threats that could put your business at risk?

Malicious emails have increased a whopping 600% since 2020. At the same time, ransomware is becoming more aggressive, with the average requested fee going from $5K in 2018 to $200K in 2020. It only takes one slip-up by a well-meaning team member to take down everything you’ve worked so hard to build. Make sure your whole team is educated on what cyber threats can look like and what to do if faced with a potential risk.

How does your website expose you to risk?

As cybercrime evolves, it’s important to know how your website holds up against current threats. Through our cybersecurity team and partners, we can put your site to the test against potential threats, so you can know where you stand, and we can work together to mitigate your risk.

What cyber protection is common practice for your industry and company size?

Discover how your competitors and others in your industry are protecting themselves. Using our cyber protection partner’s benchmarking tool, we can review the typical coverage of your industry for a company your size, so you’ll know exactly how you stack up.

What is your existing cyber liability, and which coverage is right for your business?

That’s what we’re here to help you find out. When you work with us to manage your cyber risk, our cybersecurity experts and partners analyze and assess the entirety of your cyber risk and build a custom program from the ground up. Our goal is to protect what you’ve built.

Cyber risks aren’t going away. But we’re here to help. We believe every business should be protected and our team is ready to partner with you to ensure your business has what it takes to stay safe online.

Contact our Cyber Security experts for a free consultation and protect your business against cyber attacks.

[hubspot type=”form” portal=”7375193″ id=”fc505768-dc0c-4d81-942d-d86c55a59363″]

For trucking and transportation companies, managing insurance isn’t for the faint of heart. Premiums are on the rise, legal settlements are increasing, and equipment is getting more expensive. In addition, new rules and legislation are changing how safety is understood and measured. As the landscape shifts, technologies that help put driver safety at the forefront are playing a key role in reshaping the industry, and also allowing technology-adapters to reduce risks and position themselves more in the driver’s seat.

Understanding Increased Premiums

Trucking insurance premium increases—combined with increases in climbing equipment costs, driver pay, and, recently, fuel—are putting pressure on trucking companies to reduce expenses where they can. According to the American Transportation Research Institute (ATRI), the average carrier cost per mile for truck insurance increased from $0.064 in 2013 to $0.075 in 2017, and the Wall Street Journal found “The cost of truck insurance premiums rose 12%, on average, to 8.4 cents a mile, in 2018 from the previous year.”

Here’s a couple of reasons why premiums have been increasing for years for trucking companies:

Nuclear Verdicts

The severity of claims fueled by nuclear verdicts—settlements that range in the millions—has increased dramatically in recent years. The enlarged size of jury awards and settlements can partly to attributed to the increased frequency of court cases referencing data from FMCSA’s Compliance, Safety, Accountability (CSA) program.

CSA data is used to identify motor carriers with safety issues and prioritize them for warning letters, interventions, and/or investigations. The data is updated monthly and is organized into seven categories, known as the Behavior Analysis and Safety Improvement Category scores (BASICs). Five of the seven BASICs are publically available online through FMCSA’s Safety Measurement System. (Congress removed some CSA data from public view in December 2015—including the Crash Risk Indicator and Hazardous Materials BASICs—due to concerns about the data accurately portraying carrier performance.)

With BASIC scores like Hours of Service, Unsafe Driving, and Vehicle Maintenance openly accessible, lawyers can use compliance history in combination with accident details to try to establish negligence in a court of law. This strategy can result in high jury verdicts and defense costs.

As a result, claims that might have been $200,000 five years ago have risen to $500,000 in some cases. Significantly higher settlements, jury verdicts, and fear of potential jury verdicts have increased reserve forecasts, which in turn have had a direct effect on defense costs and insurance premiums. Premiums that may have averaged $6,000- $7,000 earlier in the decade can now run 20-50% higher, especially if the voluntary insurance market continues to decline and State Assigned Risks programs are the only takers.

Some companies believe the factors that contribute to BASIC scores have no direct correlation to how safe they are as a company. Although the CSA scoring is not perfect, the methodology is directionally accurate and typically the motor carriers that complain about their scores do not perform as well as their competitors. When carriers choose not to invest in safety policies and proven safety technologies, it is arguable that profitability is being placed ahead of safety, which can further increase litigation costs.

CSA Scores Changing to More “Rigorous” Data-Driven Model

Currently, the Federal Motor Carrier Safety Administration (FMCSA) uses CSA scores as the primary means to identify high-risk motor carriers. But a new statistical model—the IRT model—being explored by the FMCSA would utilize data to measure a motor carrier’s “safety culture,” rather than attempt to predict its likelihood of a crash, according to a piece in Transport Topics. However, it has been widely reported that FMCSA officials will not make a decision until September 2020 about whether to adopt the IRT model, which is complex and may be difficult to explain to the trucking industry.

In this litigious environment, carriers that choose to invest in safety technology and embrace statistical models will have more data-driven resources to help try to dissuade claimants from landing a lottery-type award.

Improving Safety Proactively

Instead of just going along for the ride, trucking companies can consider taking matters into their own hands by investing in technologies that can help substantially reduce risks, as well as gathering data that can reinforce a culture of safety. In many cases, the cost of avoiding one nuclear verdict may offset, or even pay for the investment. Here are a few of the most popular safety technologies being implemented by trucking companies:

- Dash Cams: Dashboard cameras on trucks are becoming table stakes and have already been positively reducing premiums. In some cases, cameras can completely eliminate a possible accident claim which would had been a difficult “he said / she said” battle in the past. Even in the case of a head-on collision, dashboard cameras simplify determining who is at fault. An easy video review process can even exonerate a driver on the spot.

- Collision Avoidance Systems: Smart anti-collision technologies that sense when a vehicle is getting too close, and apply the brakes on behalf of the driver, are already mitigating risks. While the technology has been around for several years, more 2020 rigs promise to come equipped with this technology already in place, and other retrofit options have recently come to market for older trucks. These technologies don’t just help drivers avoid accidents; they also lay the foundation for safer practices by collecting data that can be used to retrain drivers, or to create full driver safety programs for a company to make the entire fleet safer. While equipping rigs with collision avoidance technology may cost $30,000-$50,000 extra, with fewer collisions, diminished severity of claims, and more affordable premiums, the dividends can pay off down the road.

- Anti-Fatigue Technology: A slew of innovative new technologies are beginning to hit the industry to help diminish driver fatigue. While dash cams can retroactively show whether a driver was asleep at the wheel in the event of an accident, predictive technology can reduce the likelihood of dangerous scenarios. For example, fatigue meters technology uses hours-of-service logs to predict driver fatigue levels, updating managers with thorough assessments for every driver in the fleet. Wearables (like a Fitbit-like device) are similarly analyzing fatigue by measuring body movements, assessing sleep quantity, and predicting when alertness will start to decline. Even facial mapping technologies that look for symptoms of fatigue from a driver’s face, such as yawning or head nodding, can estimate driver alertness.

Data gathered from these new safety technologies can not only help identify and sideline potentially dangerous or fatigued drivers, but also help lead to more personalized training and hours-of-service regulations for each driver to increase safety.

It’s been said that you can’t stop progress. In this case, technology has come to the trucking and transportation industry. While retrofitting trucks with safety-centered technology or buying new trucks with technology already installed can seem expensive and arduous for many industry veterans, encouraging a safety-centered culture that protects drivers can pay off in the long term in the form of reduced accidents (and lawsuits), as well as lower premiums. Those in the industry quickest to embrace a safety-first mentality and support it with the best tools and protocols currently available will be ready to evolve and be more attractive to potential employees.

Peter Smelzer, AAI, AIS is a Fleet Risk Advisor for Relation Insurance Services. He can be reached at [email protected] or on LinkedIn.